Credit Counselling with EDUdebt: Your Relied On Partner in Singapore

Exploring Credit History Therapy Solutions: What You Required to Know for Effective Financial Obligation Monitoring

Browsing the intricacies of financial debt administration can be daunting, specifically for those dealing with significant financial strain. Credit score counselling solutions have actually become a sensible solution, using professional help tailored to specific scenarios. These solutions not just supply calculated financial preparation however also assist in communication with lenders to discuss extra desirable repayment terms. However, recognizing the subtleties of these services and identifying the ideal counsellor is important for achieving long lasting economic security. What necessary aspects should one think about before involving with a debt counsellor to make sure optimal end results?

Comprehending Credit Rating Therapy Services

Credit rating coaching solutions offer as an important source for people fighting with debt administration (click here). These solutions use specialist advice and support to assist consumers browse their monetary obstacles. Commonly offered by licensed debt counsellors, these programs aim to inform people about their economic circumstance, including their credit rating records, exceptional financial obligations, and general monetary wellness

Counsellors assess a client's financial standing with comprehensive assessments, that include income, costs, and financial debt degrees. Based upon this evaluation, they establish tailored plans that might entail budgeting approaches, financial debt payment alternatives, and financial education. Debt counselling solutions usually promote interaction in between creditors and customers, helping to discuss extra favorable repayment terms or settlements.

These services can be specifically advantageous for those dealing with overwhelming financial obligation or thinking about personal bankruptcy, as they provide an alternative path to economic recuperation. Furthermore, credit history counselling can instill enhanced monetary routines, empowering individuals to make enlightened decisions about their cash in the future. It is important for customers looking for these solutions to choose reputable organizations, as the top quality and method of credit rating therapy can differ dramatically among suppliers.

Benefits of Credit Scores Therapy

Several people experience substantial relief and empowerment through debt counselling solutions, which provide various advantages that can transform their financial overview. One of the primary benefits is the tailored economic guidance supplied by licensed credit history counsellors. These professionals examine a person's monetary situation and tailor a plan that addresses certain financial debt challenges, aiding clients regain control over their finances.

One more important advantage is the capacity for discussing reduced rates of interest and even more convenient payment terms with financial institutions. This can lead to substantial financial savings and a quicker path to financial security. Lastly, joining credit therapy can improve one's credit scores rating gradually, as clients show responsible monetary actions. On the whole, the benefits of credit rating therapy solutions expand beyond prompt financial debt relief, using a comprehensive method to accomplishing long lasting financial health and well-being.

How Credit Score Counselling Functions

Understanding the mechanics of credit rating counselling is essential for individuals looking for efficient financial debt monitoring options. Debt counselling typically starts with an extensive analysis of an individual's financial situation - click here. Throughout this preliminary consultation, a certified credit rating counsellor assesses income, expenditures, and financial debts to recognize details difficulties

Following this analysis, the credit history counsellor develops a personalized activity strategy customized to the person's one-of-a-kind scenarios. This strategy commonly consists of budgeting strategies and suggestions for lowering expenditures, along with pointers for increasing revenue ideally.

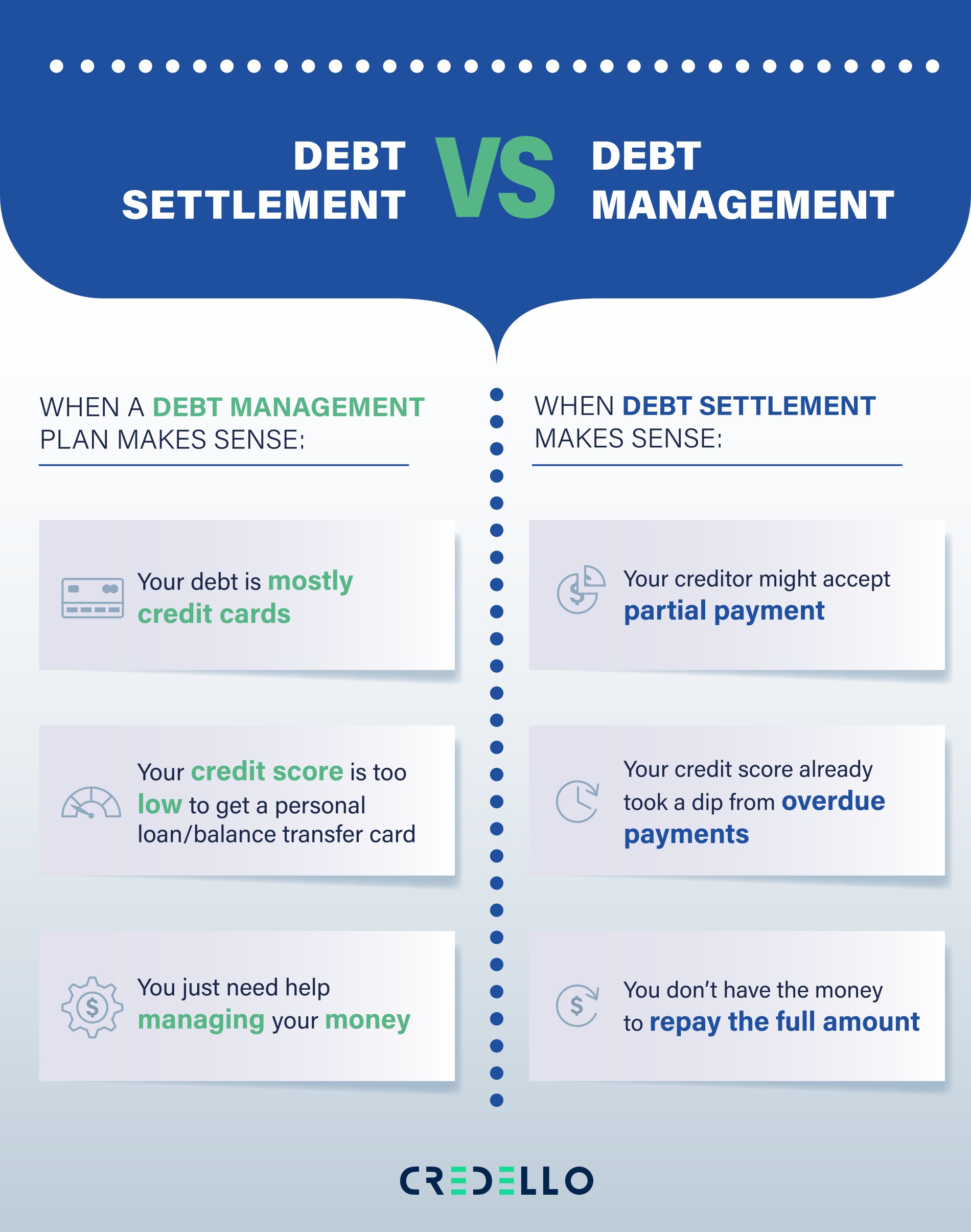

One trick element of credit history coaching is the facility of a financial obligation monitoring strategy (DMP) If regarded suitable, the counsellor bargains with creditors to secure much more desirable settlement terms, such as lower rate of interest prices or extensive payment periods. This can significantly ease monetary stress.

Throughout the procedure, credit counsellors offer continuous support and education, empowering people with the expertise and abilities required to achieve lasting economic stability. Normal follow-ups make certain responsibility and assist customers remain on track with their monetary goals. Eventually, effective debt coaching not only addresses immediate debt worries however likewise fosters sustainable monetary behaviors for the future.

Picking the Right Credit Scores Counsellor

When navigating the complex landscape of debt administration, selecting the right credit scores Discover More counsellor is crucial for achieving successful results. The suitable credit score counsellor should possess qualifications and experience that confirm their knowledge. Look for qualified specialists connected with trustworthy organizations, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Organization of America (FCAA)

In addition, take into consideration the coaching strategy they employ. An extensive assessment of your financial situation should precede any kind of prescribed services. This makes sure that the approaches supplied are tailored to your particular demands instead of generic recommendations.

Transparency is an additional important aspect. A credible counsellor will provide clear info regarding fees, solutions provided, and prospective outcomes. Beware of counsellors who assure impractical results or utilize high-pressure sales techniques.

Furthermore, gauge their communication design. A great debt counsellor need to be approachable, patient, and ready to answer your concerns. Developing a relationship is necessary for an efficient working connection.

Lastly, seek references or check out on-line reviews to assess the counsellor's online reputation. By carefully reviewing these elements, you can choose a credit rating counsellor that will successfully help you in your trip towards economic stability.

Tips for Effective Financial Debt Management

Reliable financial debt administration calls for a tactical method that incorporates several essential techniques. Initially, developing a comprehensive budget plan is vital. This should outline your income, expenditures, and financial debt commitments, allowing you to determine locations where you can reduce prices and allot more funds in the direction of financial debt repayment.

2nd, prioritize your financial obligations by concentrating on high-interest accounts first, while making minimum settlements on others. This method, understood as the avalanche method, can save you money in passion her comment is here with time. Additionally, the snowball technique, which stresses repaying smaller sized financial obligations first, can supply mental motivation.

Third, develop a reserve. When unanticipated expenditures develop, having financial savings set aside helps prevent brand-new debt buildup. Furthermore, think about working out with financial institutions for far better terms or lower passion prices, which can ease your payment concern.

Last but not least, seek professional support from credit scores therapy services if needed. These professionals can give customized suggestions and assistance for your unique monetary situation, aiding you stay answerable and concentrated on your goals. By carrying out these strategies, you can successfully manage your financial obligation and pursue attaining economic stability.

Conclusion

Finally, credit score therapy solutions play an important duty in reliable debt management by supplying customized advice and support. These solutions encourage individuals to establish tailored activity strategies and work out positive terms with financial institutions, eventually causing improved monetary proficiency and stability. Choosing the proper credit history counsellor is necessary to make the most of benefits, and executing effective financial debt monitoring approaches fosters long-lasting economic health and wellness. Involving with credit scores coaching can significantly enhance one's ability to browse economic difficulties and attain monetary goals.

Generally provided by licensed credit rating counsellors, these programs aim to educate individuals about their economic circumstance, including their debt records, impressive financial obligations, and general monetary health and wellness.

Getting involved in credit report counselling can enhance one's credit scores score over time, as clients show accountable economic habits. In general, the advantages of debt coaching services extend beyond prompt financial obligation relief, supplying a detailed technique to achieving lasting economic health and wellness and well-being.

Ultimately, reliable credit rating therapy not just addresses immediate financial obligation issues yet likewise read what he said fosters lasting economic behaviors for the future.